Gifts That Pay You Income

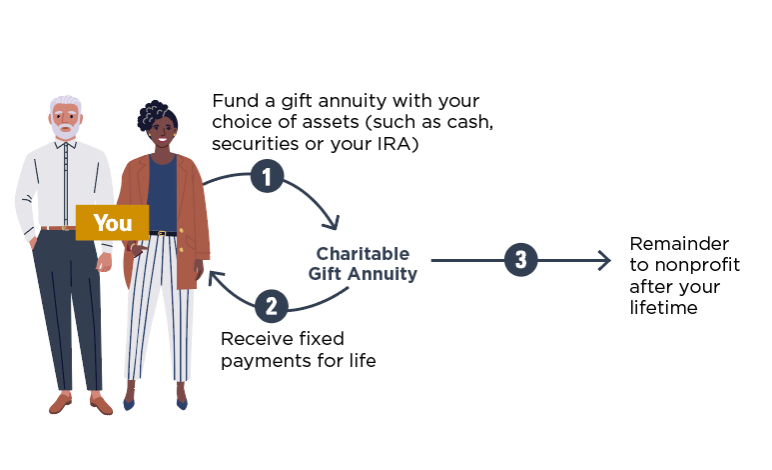

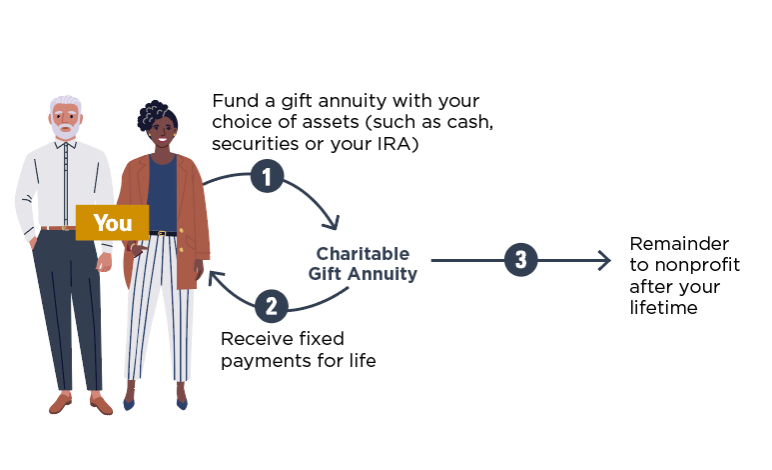

A charitable gift annuity is a way for you to support a qualified charity and feel confident that you have dependable income in your retirement years.

With a charitable gift annuity, you agree to make a gift to a qualified charity and they, in return, agree to pay you (and someone else, if you choose) a fixed amount each year for the rest of your life. The balance is used to support their work.

This type of donation can provide you with regular payments for life and allow a qualified charity to further their mission. You can also qualify for a variety of tax benefits depending on how you fund your gift.

If you fund your gift annuity with cash or appreciated property, you qualify for a federal income tax deduction if you itemize. In addition, you can minimize capital gains taxes when you fund your gift with appreciated property.

Charitable Gift Annuity Funded with an IRA

You can also fund your gift using your IRA assets. If you are 70½ and older, you can make a once-in-a-lifetime election to fund one or more gift annuities. If funded in 2024, the maximum funding amount is $54,000 (2025). This amount is adjusted each year for inflation and will increase to $55,000 in 2026. While your gift does not qualify for an income tax deduction, it does escape income tax liability on the transfer and count toward all or part of your required minimum distributions.

Important Things to Consider with This Gift

- If you are required to take minimum distributions, you can use your gift to satisfy all or part of your obligation.

- You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

- Please note that all payments distributed by a Charitable Gift Annuity funded with assets from an IRA will be subject to ordinary income tax.

Deferred Charitable Gift Annuity

Like a standard charitable gift annuity, a deferred charitable gift annuity allows you to postpone the first payment to a date of your choice. At the time of your gift, you still receive an immediate tax deduction, but you can choose to defer the start date of income payments you receive from the qualified charity.

Many individuals like this option because it allows them to save money for future expenses or plans, such as retirement. This is also a great option if you’re someone who wants to secure your support of a qualified charity now, while setting aside funds for the future.

Benefits to you:

- Receive an immediate income tax deduction.

- Potentially reduce your taxes by removing assets from your estate.

- Benefit yourself or others with steady income at a future date.

There is also the option to make a gift by setting up a flexible annuity, which is much like a deferred annuity, but you do not need to establish the date of first payment at the time you make your gift. Instead, you give yourself the flexibility to finalize the date closer to the time of payment. This allows you to consider the timing of other events in your life, particularly retirement.

Watch this 2-minute video to learn more about how CGAs work and how they might be a benefit to you.

An Example of How It Works

Dennis, 75, and Mary, 73, want to make a contribution to a qualified charity but they also want to ensure that they have dependable income during their retirement years. They fund a $25,000 charitable gift annuity with appreciated stock that they originally purchased for $10,000.

Based on their ages, they will receive a payment rate of 6.0%, which means that they will receive $1,500 each year for the remainder of their lives. They are also eligible for a federal income tax charitable deduction of $8,792* when they itemize. Finally, they know that after their lifetimes, the remaining amount will be used to support our mission.

*Based on a 5.2% charitable midterm federal rate. Deductions and calculations will vary depending on your personal circumstances.

What is Your Suggested Rate?

To find out the suggested rate for either a single-life annuity (one person receiving annuity payments) or a two-life annuity (two people receiving annuity payments), as well as the potential charitable deduction, please use this gift calculator.

Finding a Qualified Charity

Although ACGA does not offer gift annuities itself, you can review an alphabetical list of our member organizations that offer charitable gift annuities. Please contact them directly to see if they are registered to offer charitable gift annuities in your state.

Thank you to The Stelter Company for providing this content.

|