| ACGA Report on Progress in Resolving Gift Annuity Rate Challenges in New York State |

| News |

|

The American Council on Gift Annuities (ACGA) is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout rates. New York Bill A4599a was signed into law by Governor Kathy Hochul on October 25, 2023. Background: The ACGA has promulgated suggested maximum payout rates since 1927 that equate to at least a 50% residuum to issuing charities nationwide. New York State law also requires charities to use charitable gift annuity payout rates that are estimated to provide a 50% residuum to the issuing charity. Additionally, The New York Department of Financial Services (NYDFS) is required by statute to independently publish maximum allowable payout rates for charitable gift annuities with a target residuum of 50%. Until recently, the ACGA suggested rates have consistently been lower than NYDFS rates. However, in 2020, NYDFS implemented a new methodology that causes its maximum allowable payout rates to be adjusted quarterly. The NYDFS rates are also gender-specific. The constant adjustment of rates and the gender specificity of those rates increase the costs and complexity to charities. Further, as NYDFS rates apply to only New York State residents, the new methodology puts New York State residents and charities at a disadvantage relative to donors and charities in other states should NY rates be lower than the ACGA suggested rates. New York is the only state to promulgate maximum allowable payout rates. Their rates tables can be found here. Click the “Present Value of Immediate Annuities . . .” link on this page to view the latest tables. The maximum allowable payout rate under the current statute is calculated by dividing the maximum income by 10 for the age in question. The table for a quarter applies to gift annuities made during that quarter. However, if the rates for the new quarter have not yet been published, the rate from the preceding quarter may be used. Quarterly rates are typically published by the 10th day of each new quarter. Solution: Over the last three years, the ACGA has been in close contact with NYDFS and we have a tentative solution to allow charities to use a single table of unisex rates and to use a simpler calculation for maximum allowable rates under New York statute. The solution requires a legislative change and the ACGA is working on behalf of its membership to effect that change. Our next step will be to work with New York State legislators to implement the change to the statutes.

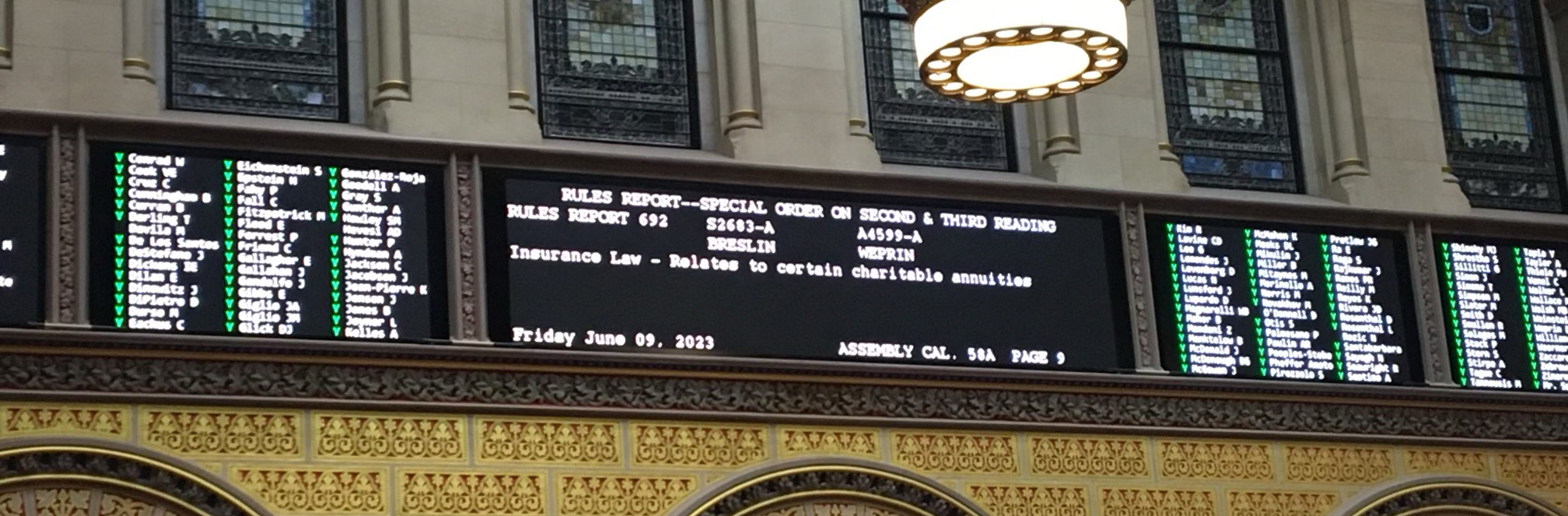

ACGA update as of 1/31/24: An update on New York Rates: Recently, the New York Department of Financial Services in adopting the recently passed NY Bill A4599a officially signed into law on October 25, 2023, confirms that ACGA rates are acceptable for New York donors and charities to follow. As a reminder, ACGA has done the largest mortality survey EVER, and ACGA understands the ratio should be 45/55 (male/Female), and, therefore, charities should rely on our rates. ACGA update as 10/26/23: The ACGA is pleased to announce that New York Bill A4599a was officially signed into law by Governor Kathy Hochul on October 25, 2023. This law codifies changes in the New York regulatory code so that New York charities can continue to rely on ACGA rates and becomes effective in 90 days on January 23, 2024. This is a fantastic win for charities and donors as it brings clarity to which rates are acceptable in New York. This has been an effort that spanned several years of work by the volunteer board of the American Council on Gift Annuities on behalf of all charities. By continuing to support the ACGA, your membership results in impactful work like this that benefits all of us in the philanthropic community. ACGA Member update as of 6/9/23: The ACGA is pleased to announce that on June 8th, 2023, the New York Legislature passed Bill A4599-A. This bill establishes that New York's maximum allowable payout rates will be unisex in nature and simplifies the suggested maximum charitable gift annuities rates for New York organizations and donors. The new methodology in New York will allow charities to rely on ACGA rates and will also allow the New York Department of Financial Services (NYDFS) to continue to regulate organizations that might want to issue charitable gift annuities with rates that would be higher than permissible by NYDFS regulations. This significant accomplishment is the result of the ACGA's tireless work to recognize and address the issue of maximum rates allowed by the state of New York. NYDFS has also let ACGA know that they will publish new NYDFS rates as soon as the law becomes effective. The ACGA continues to work on behalf of the membership to effectuate the change. Many ACGA members and other charities have been impacted by the New York statutes that set maximum charitable gift annuity rates in that state. Previous statutes and the methodology used by NYDFS, created recent cases where the ACGA suggested maximum rates were higher than those allowed by New York. This caused confusion and disruption to charities and donors. ACGA Member update as of 1/12/23: As of January 5th, the New York Department of Financial Services have posted their maximum allowed rates for Charitable Gift Annuities. NY is using a return assumption of 5%. As the new ACGA rates use an assumption of 4.25%, the newly released ACGA rates are lower than the maximum rates allowed by NY. This means charities in NY, and those registered in NY, can continue to use the suggested maximum ACGA rates for single and joint CGA gifts and remain in compliance with NY regulations. The ACGA continues to work directly with NY to update the statutes to avoid this conflict in the future. ACGA Member update as of 10/18/22: On July 7, 2021, Assembly Member Kevin Cahill introduced AB 8164, which would allow charities to use a single table of unisex annuity rates. It also revises the criteria for determining New York’s maximum annuity rates in a way that makes it very unlikely New York’s rates will continue to be lower than the ACGA’s suggested maximum rates for any one-life or two-life annuity. On January 5, 2022, AB 8164 was referred to the New York Legislature’s Insurance Committee. On January 25, 2022, New York Senate Bill S8134, sponsored by Senator Neil Breslin, and identical to AB 8164, was also referred to the Insurance Committee. This means the bill now has the two sponsors it needs to move forward. These are critical steps toward updating New York’s insurance law so that charities can offer ACGA rates to all New York donors. Unfortunately, the NY Senate passed the bill, while the NY State Assembly did not take up the bill before adjourning for 2022. The ACGA will continue to work with NYDFS and others so that changes to the statutes can be implemented. We hope we'll have better news in 2023. In the mean time, the recent increase in interest rates means that the ACGA rates are generally lower than the NY maximum allowable rates and charities can rely on the ACGA suggested maximum rates. The revised statute will take effect 90 days after it becomes law. In the meantime, charities issuing gift annuities to New York residents should continue to use the rates promulgated by the New York Department of Financial Services (again, click the “Present Value of Immediate Annuities . . .” link on this page to view the latest tables.). This latest progress demonstrates the benefit of a strong ACGA that can advocate effectively for its members and sponsors. We will continue to update members as events unfold. Thank you to all our ACGA members and sponsors for the support that makes our advocacy on your behalf possible. If you are not an ACGA member, please consider becoming one. Your support will help the ACGA continue to promote responsible philanthropy. |

| Last Updated on Friday, October 11, 2024 03:39 PM |